Achieving the goal of the Paris Agreement - limiting global temperature growth to 1.5-2°С in relation to the pre-industrial period - is impossible without the transition of the world economy to a low-carbon development path. Decarbonization of energy-intensive sectors of the economy depends on the development and deployment of new, "green" technologies, which require investment. Today we show how the financial sector can help move us closer to our climate goals.

Banks and investment firms, as demand-side actors, are not directly responsible for greenhouse gas (GHG) emissions. However, the financial sector, which has a significant impact on the economic development of countries, shapes demand and thus "points" to a promising direction for investment. This unique role of the financial sector offers new opportunities for the decarbonization of economies. By developing green finance instead of "traditional" subsidies and financing of fossil fuel-based energy, financial institutions have a direct impact on the decarbonization process.

UNEP FI estimates that to fully decarbonize the world economy, investments of the order of $5-7 billion per year are needed. For example, financing the full electricity cycle: exploration, extraction and transportation of fossil fuels, to generation and transmission, and to a final consumer - requires tens of trillions of dollars per year. There is an urgent need to reallocate financial flows in favor of a massive use of renewable energy sources (RES), energy-efficient technologies, and the development of innovative new zero-GHG technologies.

There are several ways for financial institutions to contribute to carbon neutrality. For example, lenders can link GHG emissions to lending terms when it comes to financing green projects as well as energy-efficient materials and technologies. Carbon performance requirements can be set as part of the procurement process for their projects, including closed-loop solutions. One of the requirements could be the use of renewable electricity to support production activities. In addition, financial institutions can decarbonize their own investments, which we will talk more about in a separate blog entry.

Many world-renowned companies have already contributed to the decarbonization of the economy. In 2019, one of the largest insurance companies, Allianz, announced that it would stop insuring coal-fired power plants and mines, and exclude all coal industry risks from its portfolio until 2040. A similar decision was taken by Munich Re, Swiss Re, Zurich, Scor and Axa. At the 2021 Conference of the Parties (COP26) to the UN Framework Convention on Climate Change (UNFCCC) in Glasgow, six major international banks (City, Goldman Sachs, INC, Societe Generale, Standard Chartered and UniCredit) defined common standards of action to decarbonize steel production.

During COP26, more than 450 financial institutions with more than $130 trillion in assets took the initiative to decarbonize their investments. The Glasgow Financial Alliance for Net Zero (GFANZ) made public commitments to accelerate the transition to zero emissions no later than 2050. At its core, GFANZ is a global coalition of leading financial institutions, encompassing several different initiatives for banks, insurance companies, asset managers, etc. The Alliance currently encompasses more than 160 companies with $70 trillion in assets. GFANZ members pledge to report annually on the carbon emissions associated with the projects they lend to.

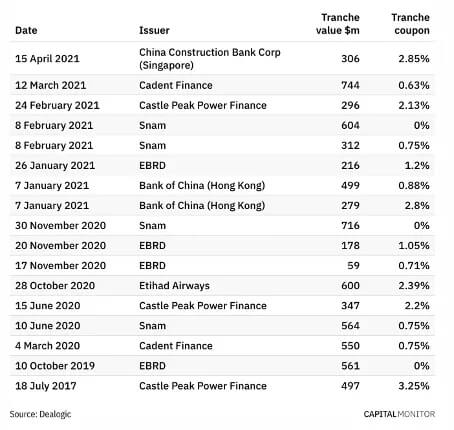

At present, international financial institutions such as the Asian Development Bank, the World Bank and the International Finance Corporation, the European Bank for Reconstruction and Development, and the European Investment Bank are already beginning to invest in programs related to the decarbonization of economies and their individual sectors in developing countries. As a rule, such programs include grant support and technical assistance components. New financial products and funds such as Green Bonds, Climate Bonds, and Transition Bonds are beginning to appear in financial markets (see Table 1).

Banks and investment firms, as demand-side actors, are not directly responsible for greenhouse gas (GHG) emissions. However, the financial sector, which has a significant impact on the economic development of countries, shapes demand and thus "points" to a promising direction for investment. This unique role of the financial sector offers new opportunities for the decarbonization of economies. By developing green finance instead of "traditional" subsidies and financing of fossil fuel-based energy, financial institutions have a direct impact on the decarbonization process.

UNEP FI estimates that to fully decarbonize the world economy, investments of the order of $5-7 billion per year are needed. For example, financing the full electricity cycle: exploration, extraction and transportation of fossil fuels, to generation and transmission, and to a final consumer - requires tens of trillions of dollars per year. There is an urgent need to reallocate financial flows in favor of a massive use of renewable energy sources (RES), energy-efficient technologies, and the development of innovative new zero-GHG technologies.

There are several ways for financial institutions to contribute to carbon neutrality. For example, lenders can link GHG emissions to lending terms when it comes to financing green projects as well as energy-efficient materials and technologies. Carbon performance requirements can be set as part of the procurement process for their projects, including closed-loop solutions. One of the requirements could be the use of renewable electricity to support production activities. In addition, financial institutions can decarbonize their own investments, which we will talk more about in a separate blog entry.

Many world-renowned companies have already contributed to the decarbonization of the economy. In 2019, one of the largest insurance companies, Allianz, announced that it would stop insuring coal-fired power plants and mines, and exclude all coal industry risks from its portfolio until 2040. A similar decision was taken by Munich Re, Swiss Re, Zurich, Scor and Axa. At the 2021 Conference of the Parties (COP26) to the UN Framework Convention on Climate Change (UNFCCC) in Glasgow, six major international banks (City, Goldman Sachs, INC, Societe Generale, Standard Chartered and UniCredit) defined common standards of action to decarbonize steel production.

During COP26, more than 450 financial institutions with more than $130 trillion in assets took the initiative to decarbonize their investments. The Glasgow Financial Alliance for Net Zero (GFANZ) made public commitments to accelerate the transition to zero emissions no later than 2050. At its core, GFANZ is a global coalition of leading financial institutions, encompassing several different initiatives for banks, insurance companies, asset managers, etc. The Alliance currently encompasses more than 160 companies with $70 trillion in assets. GFANZ members pledge to report annually on the carbon emissions associated with the projects they lend to.

At present, international financial institutions such as the Asian Development Bank, the World Bank and the International Finance Corporation, the European Bank for Reconstruction and Development, and the European Investment Bank are already beginning to invest in programs related to the decarbonization of economies and their individual sectors in developing countries. As a rule, such programs include grant support and technical assistance components. New financial products and funds such as Green Bonds, Climate Bonds, and Transition Bonds are beginning to appear in financial markets (see Table 1).

Table 1: Issue of "transitional" bonds from 2017 to 2021

Decarbonization is not only about reducing emissions in large emitting companies, but also about increasing investment in cleaner production and sectors, including new technologies. An important part of this process is the expansion of "green" investments. For this purpose, financial institutions (investment companies, banks, insurance companies) must adjust their business models and develop and implement robust decarbonization plans.

The examples cited in this article show the enormous contribution of the financial sector to the decarbonization of the global economy. Many countries are already adopting regulations restricting or prohibiting investments in carbon-intensive industries or in companies with a high carbon footprint, which do not take into account in their activities the ESG principles of sustainable development: environmental protection, creation of favorable social conditions and good corporate governance (Environmental, Social and Governance, ESG).

The examples cited in this article show the enormous contribution of the financial sector to the decarbonization of the global economy. Many countries are already adopting regulations restricting or prohibiting investments in carbon-intensive industries or in companies with a high carbon footprint, which do not take into account in their activities the ESG principles of sustainable development: environmental protection, creation of favorable social conditions and good corporate governance (Environmental, Social and Governance, ESG).

Become an innovator with Avantgarde Group

With this blog, we wanted to show that the development and implementation of decarbonization plans is a matter that requires time and resources. We at AvantGarde Group will help you evaluate the potential opportunities and risks associated with decarbonisation. Check out the Climate Finance section of our website and contact us if you think transport decarbonization is the way to go.

With this blog, we wanted to show that the development and implementation of decarbonization plans is a matter that requires time and resources. We at AvantGarde Group will help you evaluate the potential opportunities and risks associated with decarbonisation. Check out the Climate Finance section of our website and contact us if you think transport decarbonization is the way to go.